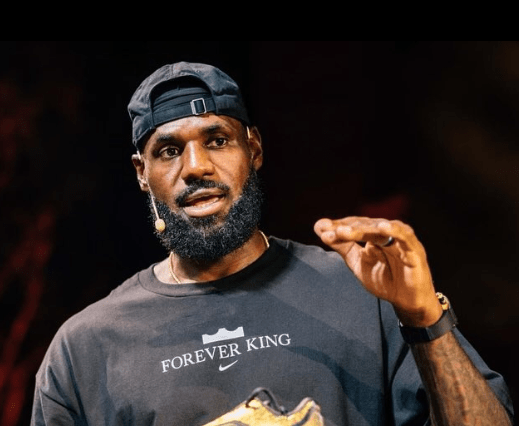

LeBron James’ success grew not just because he was a skilled basketball player but also because he approached every facet of his career as though he were running a multinational corporation and brand. He learned that stability was difficult to achieve from his early experiences growing up in temporary housing after being born to a 16-year-old single mother in Akron, Ohio. He wasn’t just a rookie when he joined the NBA in 2003 as the Cleveland Cavaliers’ first overall pick; he was the cornerstone of a new dynasty.

Multiple titles, MVP awards, and All-Star choices are just a few examples of his outstanding and well-documented on-court accomplishments. However, these are not enough to explain his projected €1.2 billion net worth in 2025. The way he used his playing career to gain ownership, stock shares, and astute investments is what makes his journey unique. He has made about US$479 million from his playing career, according to Investopedia, while also creating a business empire around his name.

LeBron James – Personal and Professional Profile

| Attribute | Details |

|---|---|

| Full Name | LeBron Raymone James Sr. |

| Date of Birth | December 30, 1984 |

| Age | 40 (as of 2025) |

| Nationality | American |

| Residence | Los Angeles, California |

| Marital Status | Married (Savannah James) |

| Children | 3 |

| Profession | Professional Basketball Player, Entrepreneur |

| Current Team | Los Angeles Lakers (NBA) |

| Career Start | 2003 (Drafted 1st overall by Cleveland Cavaliers) |

| Estimated Net Worth | €1.2 billion (2025) |

| On‑court Earnings | Over US$500 million pretax salary |

| Endorsements & Ventures | Estimated US$900 million off‑court earnings |

| Major Sponsors | Nike, Amazon, Beats by Dre, Fanatics, Taco Bell, LVMH |

| Social Impact | LeBron James Family Foundation; I PROMISE School |

| Reference Profile |

LeBron’s off-court endeavors are the main factor that separates his income from that of many other athletes. For sportsmen looking for long-term value instead of one-time endorsement cheques, his lifetime contract with Nike serves as a model. When Apple purchased Beats by Dre, his first investment apparently generated tens of millions, offering a remarkably comparable example of how stock can become a source of wealth for generations.

Meanwhile, he has been able to stay relevant beyond his playing days while actively creating value thanks to his ownership share in Fenway Sports Group, which owns Liverpool FC, and his founding role in SpringHill Company, a media company with a valuation close to US$725 million. For athletes who understand that peak performance is temporary, LeBron’s equity concept is very helpful.

What implications does this have for today’s emerging players? Athlete-entrepreneurship is replacing one-dimensional athlete contracts. A layered revenue stream is depicted in LeBron’s model, which includes his on-court pay, sponsorships, ownership investments, media output, real estate, and charitable contributions. The reported US$85 million he receives each year from endorsements alone demonstrates how high the bar has been set. More significantly, though, his strategy is much more robust because his brand, business sense, and entrepreneurial skills are far more valuable than just his athletic physique.

LeBron James is often mentioned when discussing Black wealth and representation in business. His career is a case study in wealth development, equity participation, and strategic ownership; it goes beyond simply being “superstar athlete rich.” His desire to eventually own an NBA team, for instance, indicates his goal to change his identity from asset to owner—from player to executive. In terms of how celebrity capital becomes generational infrastructure, his voice now echoes those of Michael Jordan, Rihanna, and Jay-Z.

LeBron has also had a significant cultural and social influence, once more connecting his own wealth to social change. He has dedicated millions to education and community service through the LeBron James Family Foundation and the I-PROMISE School in Akron, reaffirming that money without a purpose can be lost to time. His philanthropic endeavors go beyond simple altruism; they are calculated investments in his native area and in intergenerational mobility, which lends his financial success a nuanced dimension that goes beyond simple statistics.

LeBron himself has recently emphasized a very effective financial strategy: “I can’t start over.” There isn’t a way. He insisted that he refrains from making rash investments and views money as an asset class that should be protected and increased rather than spent. This way of thinking presents his wealth as a springboard, a structural base that fosters future development and legacy, rather than as a capstone.

Although LeBron has signed to a US$52.6 million option for the 2025–2026 season, his on-court earnings are still a big part of his wealth equation, even as he plays in his 23rd NBA season. His total off-court assets surpass his basketball revenues, thus his empire is set up to run without relying on the next basket of points or postseason run.

Peer comparison is unavoidable and educational. Recently, Stephen Curry surpassed LeBron as the NBA’s highest-paid player in a single season, but Curry’s path still reflects LeBron’s: long-term planning, brand alliances, and business ownership. LeBron’s advantage, however, is longevity and diversity; he has created value across decades and across industries, demonstrating that successful athlete-entrepreneurship depends more on consistent investing behavior than on a single big deal.