Tiger Woods’s majątek is more akin to a long, methodical accumulation than a sudden revenue explosion, the sort of pyrotechnics that swiftly fade from memory. He built his wealth and reputation over the course of more than 20 years by making decisions that, while seemingly modest at the time, turned out to be quite resilient when weighed against the shifting tides of professional sport and celebrity economics.

Woods’ financial foundation was established early on with endorsements that spanned decades, in contrast to many other elite athletes whose fortunes rely mainly on prize money or appearance fees. In 1996, he signed a professional contract with Nike, which garnered him hundreds of millions of dollars over the course of nearly three decades. In addition to being extremely profitable, the partnership was notably creative in the way it united athlete and brand with an exceptionally clear sense of shared identity, making Woods a golfing ambassador whose equipment came to be associated with his name.

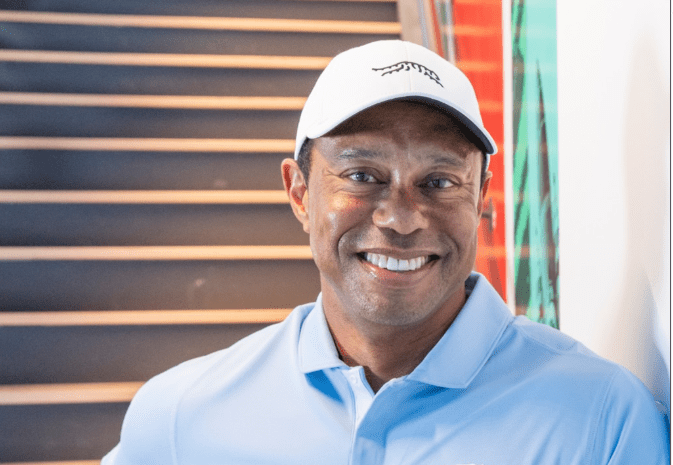

| Name | Tiger Woods |

|---|---|

| Born | December 30, 1975 |

| Nationality | American |

| Profession | Professional Golfer, Entrepreneur |

| Major Achievements | 15 Major Championships, Former World No. 1 |

| Estimated Net Worth | $1.1–$1.3 billion |

| Main Sources of Wealth | Endorsements, Business Ventures, Golf Winnings |

| Reference | Forbes |

With Gatorade, TaylorMade, Monster Energy, and other brand alliances, a similar trend emerged. These were not only token endorsements. They capitalized on what Woods embodied at his best: accuracy, skill, and a commanding athletic presence wherever he teed up. These transactions had a profoundly positive impact on his balance sheet and significantly decreased his reliance on golf winnings alone.

Although they haven’t led the narrative, prize earnings are still a part of it. Even though he has won over $120 million in tournaments over his career, such profits only make up a small portion of his overall wealth. His financial arc was bent upward by sponsorships and business endeavors, which eventually became the solid foundations of his majątek.

Entering the business world was a particularly smart choice that many athletes discuss but few carry out successfully. He is able to convert decades of strategic thought on the course into buildings that other players and fans can physically experience thanks to his course architecture firm, TGR Design. That shift from scoring to designing demonstrated a mindset that I have only observed in a small number of top competitors: a desire for effect that goes beyond individual achievement.

In order to combine hospitality with his golf-focused business, Woods has dabbled in experiential endeavors with TGR Live and The Woods eateries. Although these businesses haven’t garnered the same level of attention as his early successes, they demonstrate a wonderful sense of purpose regarding how to expand influence into fields where authenticity is important. Instead than following every new business strategy, he focused on areas where his experience gave him a significant advantage.

Although it is a part of this larger fabric of assets, real estate serves more as an anchor than as a catalyst for speculation. In an era where celebrity incomes can fluctuate greatly during peak years and subsequently plummet when popularity or public attention declines, owning real estate, such as his Florida mansion, emphasizes stability.

Then, in a financial setting rather than on a golf course, he had one of the most fascinating moments of his career. According to reports, Woods had an offer of $800 million to participate in the Saudi-backed LIV Golf Invitational Series, which started drawing elite players with huge guarantees. Even thinking about a deal of such magnitude would dominate most athletes’ conversations. Woods said no.

That decision had more to do with strategy than loyalty. His financial architecture provided security and control, so he didn’t need to seek for a cash infusion. His legacy, the environment supporting many of his commercial endeavors, and the legitimacy of his sponsorships were all safeguarded by aligning with the PGA Tour. This choice reflected his own style of playing golf, which is methodical, forward-thinking, and based on an understanding of long-term worth rather than immediate profit.

His public statements on the topic were direct but consistent with his personal beliefs. He implied that players were abandoning the competitive framework that shaped their careers by moving on to the new series. Whether or not one agrees, the comment exposed a crucial aspect of Woods’s character: his loyalty was to a system he believes is necessary to the sport he loves, not the highest bidder.

From a distance, his financial path is more like a landscape sculpted by deliberate tributaries than a river nourished by a single flood. Golf triumphs, company ventures, endorsements, and real estate income all play a part in an interaction that feels remarkably adaptable and durable. Even though his competition schedule has fluctuated owing to injuries and life outside of sport, his adaptability has maintained his majątek strong.

Woods seems to have handled his financial situation with the same flexibility that golfers train to deal with unpredictability—adjusting for wind, topography, and pressure. His story has a certain economic swing to it; it is accurate, calibrated, and sensitive to both personal legacy and market realities.

His impact on the sport is still being felt today. He formerly contributed to the growth of prize money and marketing attention that now assist younger players joining top circuits. In this way, his contributions go beyond self-interest and contribute to the fundamental development of the golf industry’s economy.

At first look, the mechanics of his wealth—contracts, equity, ventures—might appear technical, but the underlying principles have emotional resonance. It emphasizes the need of holding onto control over your story and financial interests, the value of patience, and the strength of forming alliances with like-minded others. Now that players are more interested in ownership than just endorsement cheques, that strategy seems more pertinent.

Tiger Woods’s billionaire status, which Forbes recently estimated to be between $1.1 and $1.3 billion, is a result of decades of consistently well-considered choices rather than a showy capstone. Every commitment, whether to a sponsor or a commercial endeavor, has been a thread in a fabric that seems well-made and long-lasting.

There is a hopeful undertone here: accumulating wealth does not necessitate compromising one’s morals or personality in order to achieve immediate financial benefit. According to Woods’s journey, it can be especially helpful for athletes moving between different stages of their careers and lives to match their ideals with business prospects and have the patience to allow that alignment to develop.