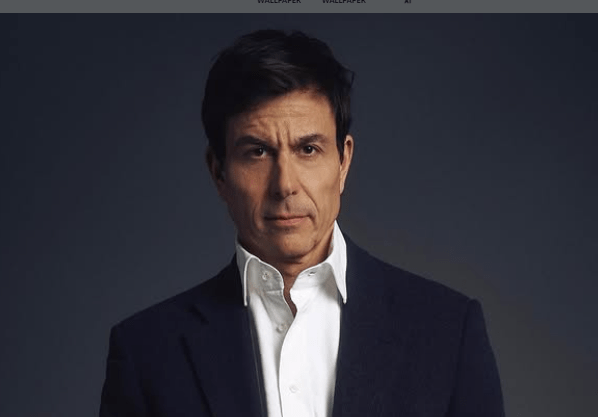

He moves calmly and methodically across the pasture. The refined Austrian engineer of domination at Mercedes-AMG Petronas, Toto Wolff, seldom ever raises his voice, but when he does, it reverberates beyond team radios. His wealth, which is currently valued at between $1.6 and $2.5 billion, comes from more than just winning races. It is the outcome of a portfolio that was constructed with the same level of accuracy as his race strategy.

Wolff negotiated the throne rather than inheriting it. His unexpected path to motorsport glory began when he joined a Russian financial firm after quitting his studies in economics in Vienna. He founded Marchfifteen, a venture capital business that reflected the dot-com aspirations of the time, by 1998. March 16th arrived six years later. Both titles represented a transition from market speed to racing speed, and they were more than just symbolic.

Toto Wolff – Key Bio and Financial Facts

| Name | Toto Wolff |

|---|---|

| Full Name | Torger Christian Wolff |

| Birth Year | 1972 |

| Nationality | Austrian |

| Current Role | Team Principal & CEO, Mercedes-AMG Petronas F1 Team |

| Net Worth Estimate | $2.5 billion (varies by source: Forbes cites $1.6B) |

| Annual Salary | Approx. €7.7 million |

| Key Holdings | 33.3% in Mercedes F1, 0.95% in Aston Martin |

| Other Ventures | Tech/startup investments, sports management company |

| Racing Career Highlight | Nürburgring 24h class win (1994) |

| Reference |

When he won a class at the Nürburgring 24-hour endurance event in 1994, the world first became aware of his racing tenacity. However, there was always an equity-wired intellect behind the visor. He made an investment in the faltering Williams Formula One team in 2009. Their victory in Spain three years later was a unique spark in an otherwise slumbering period. He played a small but important role in that tale, laying the groundwork for a jump that few anticipated.

In 2013, Wolff became a part-owner and team principal at Mercedes. This was a declaration of intent rather than merely a job. Mercedes would dominate the next eight seasons, winning seven Drivers’ crowns and eight Constructors’ Championships. The figures are still astounding. His 115 Grand Prix victories during that golden period cemented his place in F1 leadership history.

He owns 33.3% of Mercedes F1, which is a portion of the most prosperous team in the hybrid era. That’s not all, though. In a move that caused a stir in boardrooms and paddocks alike, Wolff acquired a 0.95% interest in Aston Martin through strategic expansion. Anyone observing closely would see that this wasn’t a whim. It was lawful, silent, and very deliberate placement.

Even if his base pay is thought to be €7.7 million a year, that’s just the tip of the iceberg. A complicated network of revenue is produced by dividends from team earnings, stock appreciation, and performance-linked bonuses. The benefits have been especially substantial for a man who contributed to the institutionalization of winning.

It’s interesting to note that he wagers on more than just autos. He has made investments in sports management, industrial innovation, and tech startups. Wolff co-founded a sports agency that discreetly brokers talent with former Formula One winner Mika Häkkinen. Even while this diversification isn’t very showy, it says a lot about how he regards longevity in both personal finance and the paddock.

Wolff’s unromantic approach to accomplishment is what sets him apart. In addition to openly praising Hamilton, he demanded accountability once the automobile broke down. He views the team as a high-performance machine, where every component counts and every issue can be traced. His asset management is a direct result of such mindset.

He is currently the ninth richest Austrian, according to Forbes. However, his ascent was not predicated on prominence, in contrast to many sports billionaires. Not a mega-brand with his initials on it. No massive empire on social media. Simply consistent compounding—of skill, equity, and accuracy.

Wolff continues to be a figure of long-term planning even as Red Bull’s recent supremacy changes the grid. Wins may come and go, but his equity is steadily growing. He doesn’t pursue media attention. His quiet historical footnotes eventually become chapters in financial case studies.

Like most top performers, his future is in what isn’t publicized. He has already made references to succession planning, which might involve developing new team leaders. His investments in Aston Martin and other businesses, however, indicate that he is growing outside the white boundaries of the paddock.

His racing choices and his financial approach are quite similar in that they both avoid panic. He takes a deliberate approach whether leading a group through regulatory changes or supporting a startup amid a downturn in the industry. As they say, the stillness is calculation rather than absence.

Despite the rising computational nature of sports finance in recent years, Wolff maintains a human element. He doesn’t depend only on trends or data models. He is able to read people. The structure is his bet. Above all, he maintains his momentum without veering off course.